Cryptocurrency investing offers high growth potential, but it also comes with significant volatility and risk. Many investors make the mistake of putting all their funds into one or two coins, leaving their portfolios vulnerable to sudden market swings. Diversification is a proven strategy that helps reduce risk while improving long-term returns. In 2026, with thousands of digital assets available, smart portfolio diversification is essential for sustainable crypto investing. This guide explains how to diversify your cryptocurrency portfolio effectively, helping you protect capital, manage volatility, and capture growth across multiple sectors of the crypto market.

Recommended reading: Best Cryptocurrency Wallets for Secure Storage in 2026

Invest Across Different Crypto Categories

One of the most effective ways to diversify your crypto portfolio is by investing across different cryptocurrency categories. These include large-cap coins (Bitcoin, Ethereum), DeFi tokens, Layer-2 solutions, gaming and metaverse tokens, AI-based crypto projects, and infrastructure protocols. Each category reacts differently to market conditions, helping balance risk.

For example, while DeFi tokens may surge during innovation cycles, large-cap coins often provide stability during downturns. In 2026, a category-based approach allows investors to benefit from multiple trends while avoiding overexposure to a single sector. This strategy reduces volatility and improves long-term portfolio resilience.

Balance Large-Cap and Altcoins

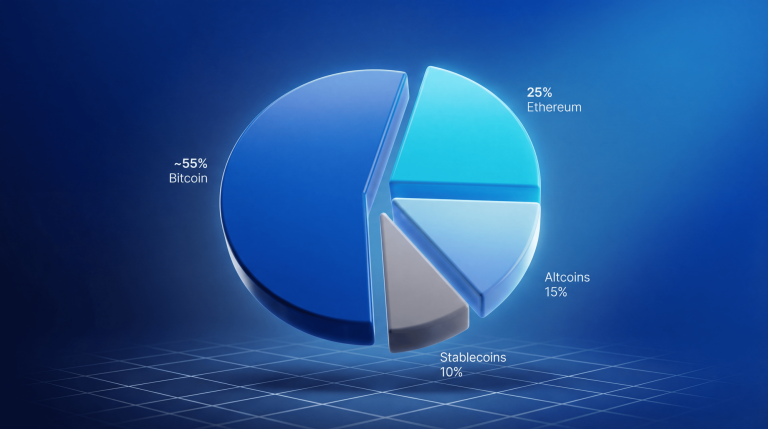

A well-diversified crypto portfolio should include a balance of large-cap cryptocurrencies and carefully selected altcoins. Bitcoin and Ethereum often act as portfolio anchors due to their market dominance and adoption. Altcoins, on the other hand, offer higher growth potential but carry more risk. Allocating a larger portion to established coins and a smaller portion to high-quality altcoins helps manage risk effectively.

In 2026, experienced investors typically allocate 50–70% to large-cap assets and the remainder to mid- and small-cap projects with strong fundamentals. This balance allows steady growth while capturing upside opportunities.

Diversify by Blockchain Networks

Investing across multiple blockchain networks further strengthens portfolio diversification. Different blockchains specialize in various use cases, such as smart contracts, scalability, privacy, or interoperability. For example, Ethereum-based projects may behave differently from Solana, Avalanche, or Polygon ecosystems. Network diversification reduces dependency on a single blockchain’s success or failure.

In 2026, cross-chain ecosystems are expanding rapidly, making it easier to invest across multiple networks. This strategy lowers technical risk and ensures exposure to innovation across the broader blockchain landscape.

Use Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a powerful diversification technique that reduces timing risk. Instead of investing all your funds at once, DCA involves investing fixed amounts at regular intervals. This strategy spreads your entry points across different price levels, reducing the impact of market volatility.

Over time, DCA results in a more stable average purchase price. In 2026, DCA remains one of the safest methods for building a diversified crypto portfolio, especially for long-term investors who want to avoid emotional decision-making and market timing errors.

Include Stablecoins for Risk Control

Stablecoins play an important role in diversification by providing stability and liquidity. Assets like USDT, USDC, or DAI are pegged to fiat currencies, helping reduce portfolio volatility during market downturns. Holding stablecoins allows investors to protect capital, earn passive income through staking or lending, and quickly seize buying opportunities when prices drop. In 2026, stablecoins act as a buffer against extreme price swings, making them a key component of a well-balanced crypto portfolio.

Recommended reading: How to Invest in Altcoins With Low Risk

Rebalance Your Portfolio Regularly

Market movements can cause your portfolio allocation to drift over time. Regular rebalancing ensures that no single asset becomes over-weighted and increases risk. Rebalancing involves selling assets that have grown disproportionately and reinvesting into under-weighted positions. This disciplined approach helps lock in profits and maintain your desired risk level. In 2026, quarterly or biannual rebalancing is a common practice among successful crypto investors, promoting consistency and long-term portfolio health.

Secure Assets Across Multiple Wallets

Diversification also applies to asset storage and security. Storing all cryptocurrencies in one wallet or exchange increases risk. Use a combination of hardware wallets, non-custodial software wallets, and reputable exchanges for active trading. This approach minimizes exposure to hacks, exchange failures, or technical issues. In 2026, secure storage practices are just as important as asset selection, ensuring your diversified portfolio remains protected.

Conclusion

Diversifying your cryptocurrency portfolio is essential for managing risk and achieving consistent long-term growth. By investing across different categories, market caps, blockchain networks, and stablecoins, and by using strategies like dollar-cost averaging and regular rebalancing, investors can reduce volatility and improve outcomes. In 2026, successful crypto investing is not about chasing hype, but about building a balanced, secure, and well-researched portfolio. Smart diversification helps you stay resilient through market cycles while positioning your investments for sustainable returns.

FAQs

Why is diversification important in crypto investing?

Diversification reduces risk by spreading investments across multiple assets, minimizing losses from a single asset’s poor performance.

How many cryptocurrencies should I hold?

Most investors hold 5–15 cryptocurrencies, depending on capital, experience, and risk tolerance.

Are stablecoins useful for diversification?

Yes, stablecoins help reduce volatility and provide liquidity during market downturns.